Bitcoin Market Indicators in October 2024 and Key Prices Level

Understanding Bitcoin's Current Market Position: Evaluating $57,533 Support, Puell Multiple Signals, and October's Historical Performance | That's TradingNEWS

Bitcoin's Recent Price Movements and Market Sentiment

Bitcoin's Current Price Struggles

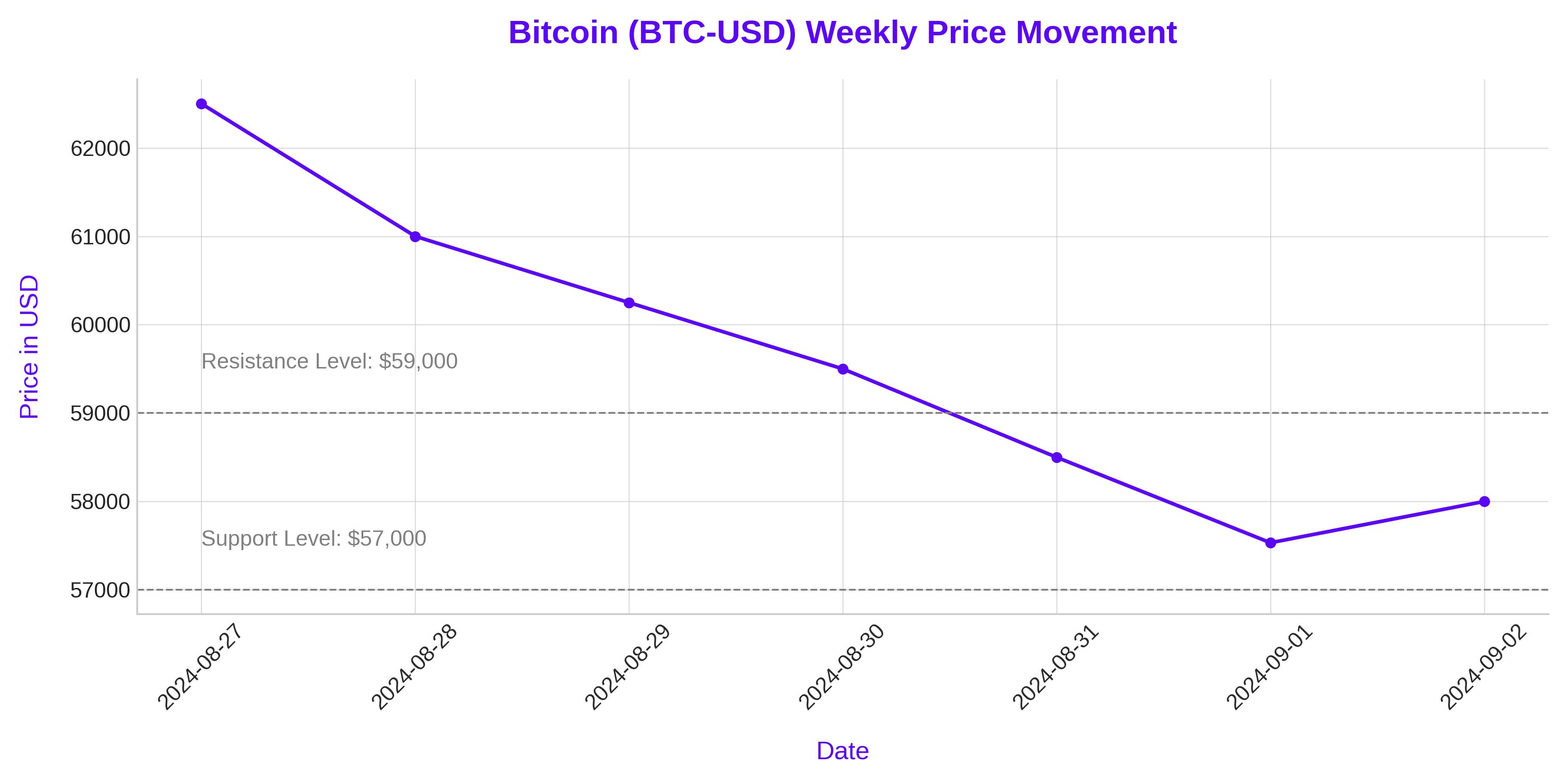

Bitcoin (BTC-USD) has recently been under significant pressure, trading around $57,533, down approximately 8.6% for the week. The asset has been struggling to break past key resistance levels, with the 50-day Exponential Moving Average (EMA) positioned at $59,662 and a Relative Strength Index (RSI) of 35 indicating a continuation of bearish sentiment. The immediate support level stands at $56,130, with potential further declines toward $54,581 and $52,907 if selling pressure persists.

Geopolitical and Legal Factors Influencing Bitcoin Prices

Impact of Geopolitical Tensions

Recent geopolitical developments have added to the volatility in the Bitcoin market. Ukrainian drone strikes on Russian oil infrastructure and escalating tensions in the Middle East have introduced a risk premium, influencing investor sentiment and driving price fluctuations. The market remains sensitive to these events, which could either exacerbate or mitigate current bearish trends depending on further developments.

Legal Recognition and Its Market Implications

The British Columbia Supreme Court's recent ruling mandating a $1.2 million repayment for a Bitcoin loan underscores the increasing legal recognition of cryptocurrencies. While this ruling could bolster long-term investor confidence by solidifying Bitcoin's legal status, the immediate impact on prices has been mixed. Legal uncertainties can introduce short-term volatility as markets adjust to new legal precedents.

Technical Indicators and Market Opportunities

Puell Multiple as a Buying Signal

The Puell Multiple, an on-chain Bitcoin indicator, is currently at 0.69, suggesting that Bitcoin may be nearing a favorable entry point for long-term investors. Historically, such levels have often signaled a buying opportunity, particularly for those employing a dollar-cost averaging (DCA) strategy. As Bitcoin trades around $58,416, this indicator points to potential re-accumulation, which could present one of the best opportunities in over two years.

Support and Resistance Levels to Watch

From a technical perspective, Bitcoin must break above the $58,739 pivot point to alleviate ongoing bearish pressure. Failure to do so could see the asset testing key support levels at $56,130, with additional downside targets at $54,581 and $52,907. Conversely, reclaiming the 50-day EMA could stabilize prices, but the market remains cautious with these levels in focus.

Market Sentiment and Institutional Inflows

ETF Flows and Institutional Interest

Bitcoin ETFs have seen a mixed response in recent weeks, with notable outflows such as Grayscale's GBTC experiencing a $26.99 million decrease. Despite these outflows, institutional interest remains, albeit more selective, as some blockchain equities and Bitcoin miner-specific investment products have recorded inflows. This dichotomy reflects cautious optimism in the institutional space, with investors carefully navigating current market conditions.

Exchange Reserves and Long-Term Outlook

A significant decline in Bitcoin reserves on exchanges, now holding just 2.39 million BTC, suggests a reduction in selling pressure, potentially favoring a bullish market if demand picks up. This reduction in exchange-held Bitcoin, coupled with ongoing institutional accumulation, could provide a foundation for future price appreciation, especially if geopolitical tensions or economic data trigger a broader market rally.

Strategic Considerations for Investors

Navigating the Current Market Landscape

Bitcoin's recent market activity has been characterized by significant volatility, presenting both challenges and opportunities for investors. As of now, Bitcoin is trading around $57,533, reflecting a notable decline of 8.6% over the past week. This drop has placed Bitcoin below key resistance levels, with the 50-day Exponential Moving Average (EMA) at $59,662 and a Relative Strength Index (RSI) at 35, both signaling a bearish outlook.

Given this environment, investors need to carefully consider their entry points. The Puell Multiple, currently at 0.69, suggests that Bitcoin may be nearing a favorable buying zone, especially for those employing a dollar-cost averaging (DCA) strategy. Historically, a Puell Multiple at this level has often indicated strong re-accumulation opportunities, making it a critical indicator for long-term investors to monitor.

Historical Trends and October's Performance Potential

October has historically been a strong month for Bitcoin, with average returns of +22.9%. If Bitcoin can break past the $58,739 pivot point and reclaim the 50-day EMA, this could signal the start of a bullish trend, offering significant upside potential. However, if Bitcoin fails to hold above key support levels at $56,130 and drops further to $54,581 or $52,907, the market could see continued bearish pressure.

Investors should also consider the impact of macroeconomic factors, such as the upcoming Federal Reserve meeting and its implications for interest rates, as these could heavily influence Bitcoin's price direction in the near term.

Balancing Risk and Reward

In the current market, the balance between risk and reward is delicate. While the bearish sentiment and recent outflows from Bitcoin ETFs, such as Grayscale's GBTC, which saw $26.99 million in net outflows, may deter some investors, the decline in Bitcoin reserves on exchanges—now down to just 2.39 million BTC—suggests reduced selling pressure. This reduction could set the stage for a future price recovery, particularly if institutional inflows resume.

For investors with a long-term perspective, the combination of historical performance trends, the Puell Multiple's signals, and the decreasing exchange reserves could present a compelling case for strategic accumulation. However, staying informed about geopolitical developments, legal rulings, and macroeconomic indicators will be crucial to navigating the ongoing market volatility and maximizing potential returns.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex